Kremlin Exaggerates Production Indexes of Russian Arms Manufacturing in 2023

Pavel Luzin

Executive Summary:

Russia’s military-industrial complex showed only modest growth in 2023. The manufacturing output index’s increase does not reflect a proportional rise in actual production.

The physical output of essential goods for arms manufacturing has revealed minimal growth over the past seven years. While some sectors expanded, overall, Russia lacks evidence of significantly increased production.

The apparent growth in aircraft and spacecraft supplies should be attributed more to inflation than actual increased production. Russia’s arms manufacturing faces complexities and potential limitations due to production challenges.

The Federal State Statistics Service of Russia, Rosstat, published the final results of industrial manufacturing in 2023 (Rosstat.gov.ru, January 31, accessed February 1, 2024). While there was no “miracle production increase” in industries related to the Russian military-industrial complex, some increase was nevertheless seen. The supplies of arms and their components from storage bases remain the primary source of material for Russia’s armed forces.

Basic Indicators

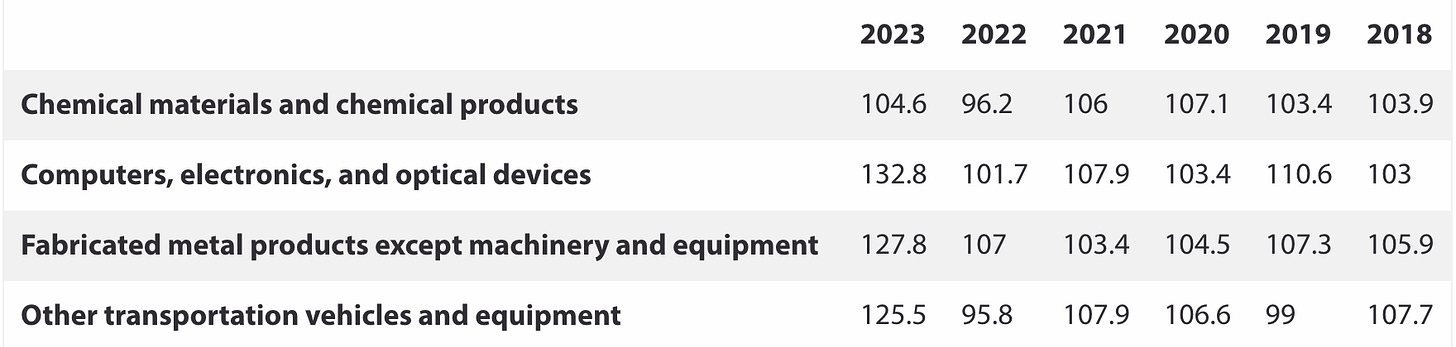

The manufacturing output index in three of four traditional industry groups related to arms production demonstrated impressive growth in 2023. However, the final index is highly dependent on changes in prices and costs, despite the statistics service’s efforts to use fixed prices in calculating the index (Rosstat.gov.ru, accessed February 1, 2024):

Table 1: The manufacturing output index in industries related to arms manufacturing, 2018–2023, ratio compared to the previous year

Note: The period is limited to 2018 because Rosstat uses 2018 as a base year for the calculation of manufacturing output indexes. In the following table, the period is limited to 2017, when the current classification of industrial sectors and goods is applied.

The increase in index does not mean a similar increase in the physical amount of production. Consequently, if we take the available physical output of some goods from different groups that are used in arms production and/or in arms systems, the picture differs:

Table 2: Physical amount of goods essential to arms manufacturing in Russia, 2017–2023

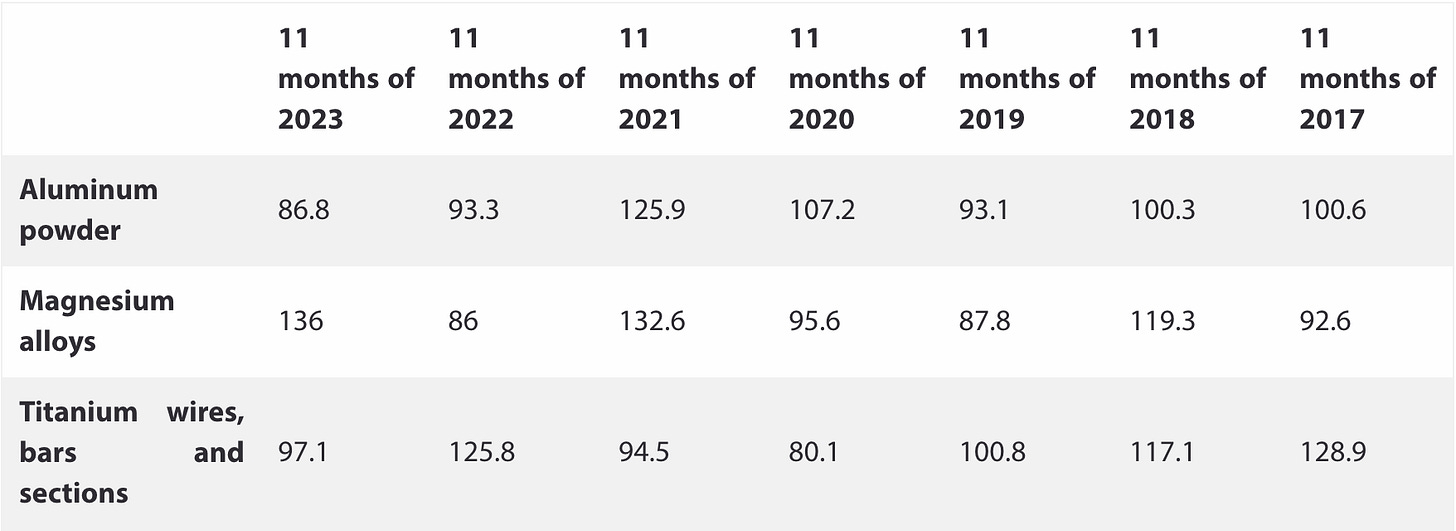

The data of the physical amount of other goods, such as aluminum powders, aluminum sections, titanium sections, and bars, etc., are available for 11 months and only in percent ratioed with the same period of the previous year:

In the last seven years, Russia did not significantly increase aluminum powder production. Still, it increased the production of magnesium alloys and titanium wires, bars, and sections by more than 40 percent. The increase in magnesium alloy production is primarily related to import substitution, as Russia still imports many of these alloys from China (Smw.ru, October 5, 2023). Despite the decrease seen in January–November 2023, the total growth of titanium products in the seven-year period was related mostly to continuing Russia’s export of these goods to Europe (Metalinfo.ru, January 18). In brief, there is no evidence that Russia produces a larger amount of all the mentioned products in such quantities as would be needed to further increase production rates of a wide range of military products, from explosives and artillery shells to aircraft and missiles.

The production of electric power also confirms that there were no crucial changes in energy-intensive arms manufacturing, despite some increase in generation:

Table 3: Electric power generation and consumption in Russia, 2017–2023, billion kWh

With this data fragmented and incomplete, there is no solid evidence that the Russian military-industrial complex quadrupled its production rates, as Russian Minister of Defense Sergei Shoigu stated several weeks ago (Kremlin.ru, December 19, 2023).

Aircraft and Spacecraft: The Most Advanced Sector of Arms Manufacturing

The supply of aircraft, spacecraft, and related equipment is another group of data, which clarifies the dynamic in the military-industrial complex of Russia. The Russian air and space sector is the country’s most advanced, complicated, and globalized sector in terms of supply chains (Rosstat.gov.ru, accessed February 1, 2024, accessed February 2, 2024):

Table 4: Supplies of aircraft, spacecraft, and related equipment, 2017–2022 and January–November 2023

It is clear that the growth of supplies in the air and space sectors denominated in current prices mainly indicates inflation in Russia rather than growth of product supplies, despite the skepticism of official producer price indexes. This conclusion can be applied to the other sectors of the Russian military-industrial complex. If true, Russian arms manufacturing is facing more challenges than its top managers and high-ranking Russian officials are willing to admit. For example, the increase of tank engine production involves many problems, and there are still a number of bottlenecks present (1obl.ru, October 21, 2023, February 1).

As a result, the supplies of arms and their components from the storage bases (including the cannibalizing of systems in storage) remain the main source of filling the needs of the Russian armed forces. These trends will likely follow into 2024 and will affect Russia’s performance in Ukraine and other conflicts.

This article was originally published in Eurasia Daily Monitor. Check it out here!

Pavel Luzin is a visiting scholar at the Fletcher School of Law and Diplomacy, Tufts University. He is also a regular contributor at The Jamestown Foundation. He is a specialist in international relations and an expert on the Russian Armed Forces. Much of his research and writings focus on Russian foreign policy and defense, space policy and non-proliferation studies.